| Read time: 3 mins

As that British institution, the HM Revenue and Customs assures us, “Tax doesn’t have to be taxing”, and certainly, when it comes to navigating compliance around tax obligations, one thing is clear - the simpler you can make your life, the better.

As every deathcare provider will know, across the United States and Canada, the expectation by each state, territory, or province is that sales tax is collected on goods and services - in a similar way to Value Added Tax (VAT) in the UK, or Goods and Services Tax (GST) in the APAC region.

That may be on items such as memorials, vaults, urns and other merchandise.

Being able to collate, manage and retrieve all of that information accurately is an essential part of fulfilling regulatory requirements for any cemetery, crematory or funeral home.

With deathcare financial processes being so complex, comprising a myriad of revenue streams and liabilities to (literally) be taken into account, simplifying and streamlining how all of that is managed helps to both assure compliance and reduce the risk of errors.

Which is why we developed the PlotBox Tax Payable Report.

The PlotBox Tax Payable Report

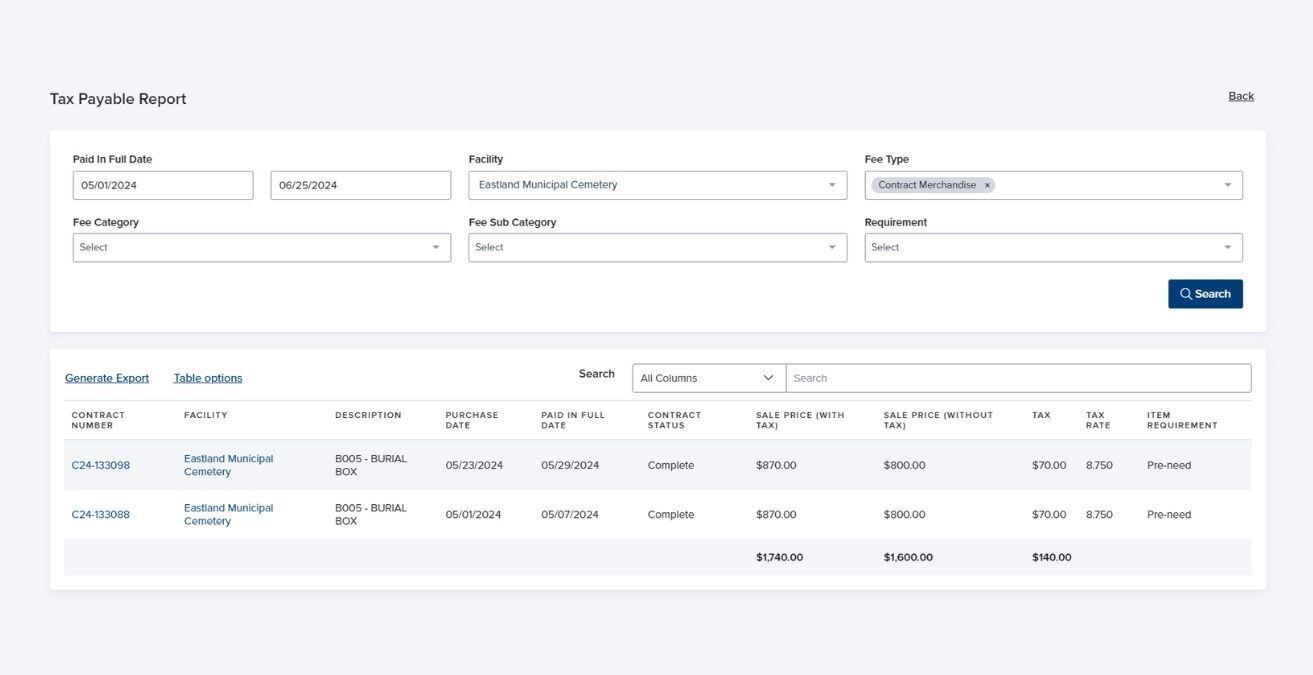

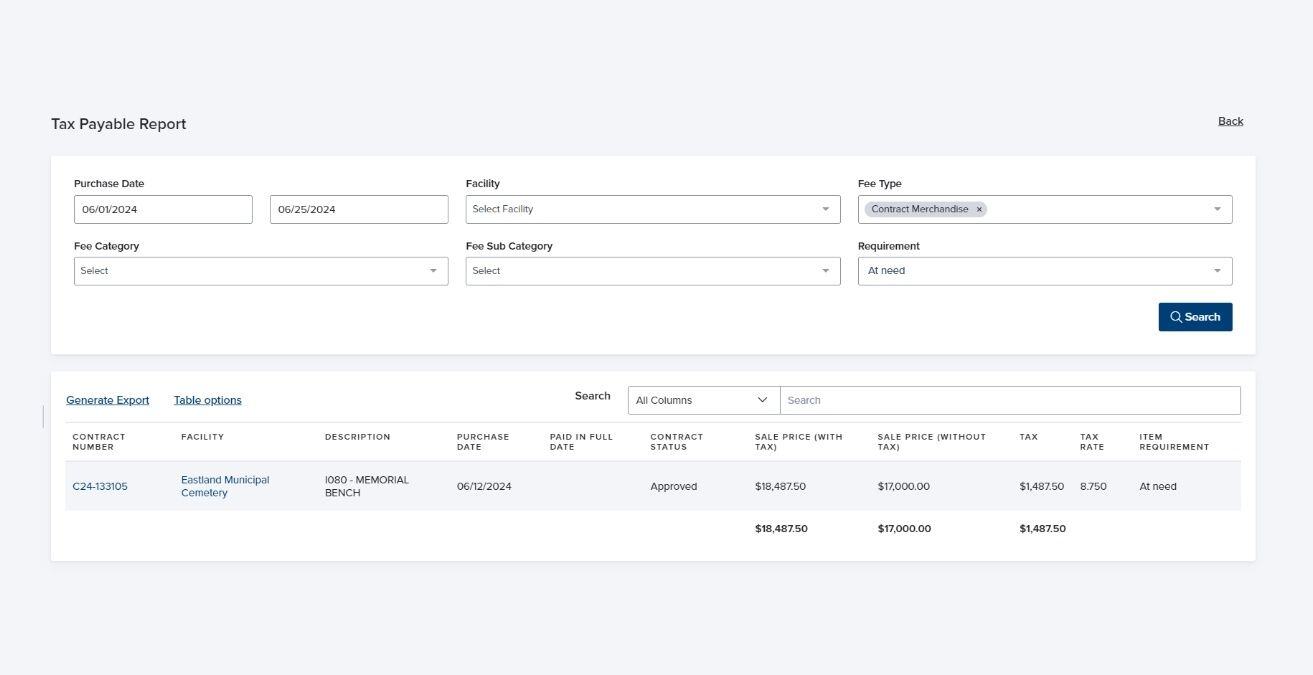

To put it simply, PlotBox has created the Tax Payable Report to help customers more easily determine and report on their tax liability.

Linked directly to contracts, the report can pull all items by facility that have a taxable amount that is payable within a selected timeframe.

The amount of tax per contract, along with a range of other information, including contract status and tax rate, can then be easily viewed, totalled and exported without having to gather, interrogate and reconcile information from a number of different sources.

Tax Rates

Speaking of tax rates, where these may be subject to change within an area, the default rate can be easily amended from within PlotBox, and similarly, the same can be set per facility, without the need to create a new fee per facility - which is then charged against relevant items as they are sold.

Tax Methods

Further to this, ‘tax methods’ can be set - as whether the tax is payable at the point of sale or payable on the completion of a contract.

In this way, tax collected can then be isolated within the report to ensure you know exactly how much tax is collected, when it is to be collected, and against what.

Why this is helpful

To return to our earlier point of tax not needing to be taxing, having all of this information easily accessible providers a number of advantages for deathcare providers:

Compliance

As tax payment schedules vary from state to state - some once a month, once a quarter and so on - all of the applicable information for the required time period can be gathered to quickly and easily in order to ascertain how much is owed.

Similarly, in terms of audit readiness, having this information organized and readily accessible is essential.

In effect, it puts cemeteries, crematories and funeral homes in the best position possible to meet their legal and statutory obligations.

Less time, fewer errors

Pulling information together from multiple sources can be time consuming at best, onerous at worst, and when collated manually - prone to errors.

Being able to automatically generate reports from a single place means more accurate data, more timely submissions and greater efficiencies overall.

Data-driven decision making

Having clear, real-time visibility of liabilities within your organization in terms of what’s coming in, what's going out and when, gives you a broader picture of your overall financial health, putting you in a better position to make informed strategic decisions that will help to ensure long-term stability.

Transparency

Transparency in terms of taxes means trust. Trust from your internal stakeholders, your customers and your regulatory bodies.

The ability to manage your taxes in a clear, accurate and transparent way ensures the accountability that helps to assure that trust.

So, as Benjamin Franklin once said, where “...in this world, nothing is certain except death and taxes”, with the right software solution, you can be sure to have a greater handle on both.

Enhance your reporting capabilities with PlotBox. Click here for more.